Trading Price Action Trading Introduction, Price Action Trading Explained

The Definition of Price Action Trading

Price Action Trading (P.A.T.) is the discipline of making all of your trading decisions from a stripped down or “naked” price chart. This means no lagging indicators outside of maybe a couple moving averages to help identify dynamic support and resistance areas and trend. All financial markets generate data about the movement of the price of a market over varying periods of time; this data is displayed on price charts. Price charts reflect the beliefs and actions of all participants (human or computer) trading a market during a specified period of time and these beliefs are portrayed on a market’s price chart in the form of “price action” (P.A.).

Đang xem: Price action trading

Whilst economic data and other global news events are the catalysts for price movement in a market, we don’t need to analyze them to trade the market successfully. The reason is pretty simple; all economic data and world news that causes price movement within a market is ultimately reflected via P.A. on a market’s price chart.

Since a market’s P.A. reflects all variables affecting that market for any given period of time, using lagging price indictors like stochastics, MACD, RSI, and others is just a flat waste of time. Price movement provides all the signals you will ever need to develop a profitable and high-probability trading system. These signals collectively are called price action trading strategies and they provide a way to make sense of a market’s price movement and help predict its future movement with a high enough degree of accuracy to give you a high-probability trading strategy.

“Clean” Charts vs. “Messy” Indicator-laden Charts

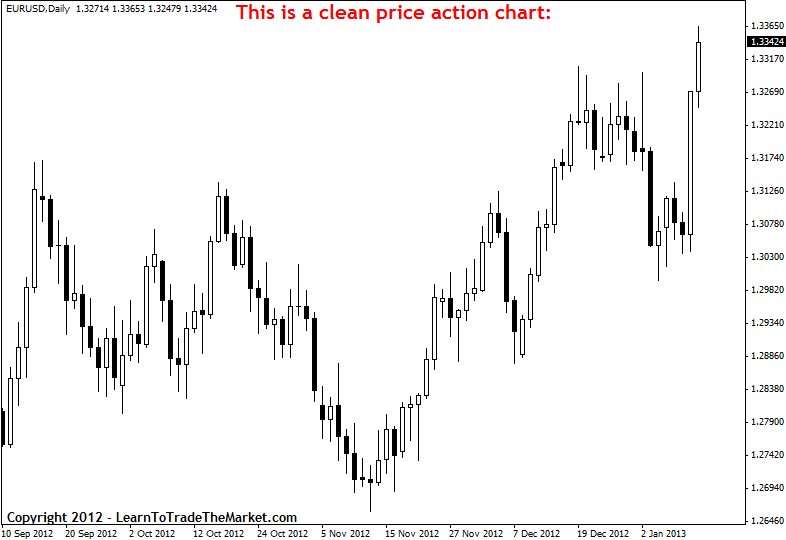

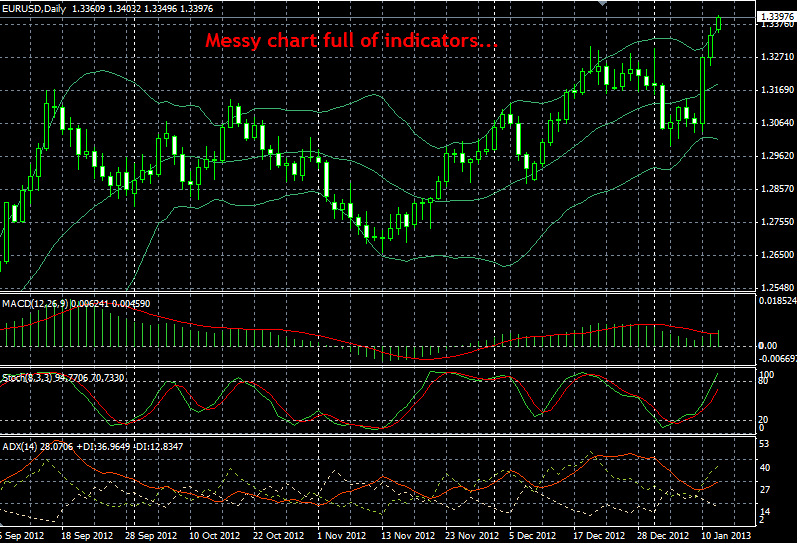

Next, to demonstrate the stark contrast between a pure P.A. chart and one with some of the most popular trading indicators on it, I have shown two charts in the examples below. The chart on the top has no indicators on it, there’s nothing but the raw P.A. of the market on that chart. The bottom chart has MACD, Stochastics, ADX and Bollinger Bands on it; four of the most widely used indicators AKA “secondary” analysis tools as they are sometimes called:

The image example below shows a clean price action chart, with no mess, and no indicators, just pure price bars:

The image example below shows a messy price action chart, with lots of clutter, indicators and mess:

It’s worth pointing out how in the indicator-laden chart you actually have to give up some room on the chart to have the indicators at the bottom, this forces you to make the P.A. part of the chart smaller, and it also draws your attention away from the natural P.A. and onto the indicators. So, not only do you have less screen area to view the P.A., but your focus is not totally on the price action of the market like it should be.

If you really look at both of those charts and think about which one is easier to analyze and trade from, the answer should be pretty clear. All of the indicators on the chart below, and indeed almost all indicators, are derived from the underlying P.A.. In other words, all traders do when they add indicators to their charts is produce more variables for themselves; they aren’t gaining any insight or predictive clues that aren’t already provided by the market’s raw price action.

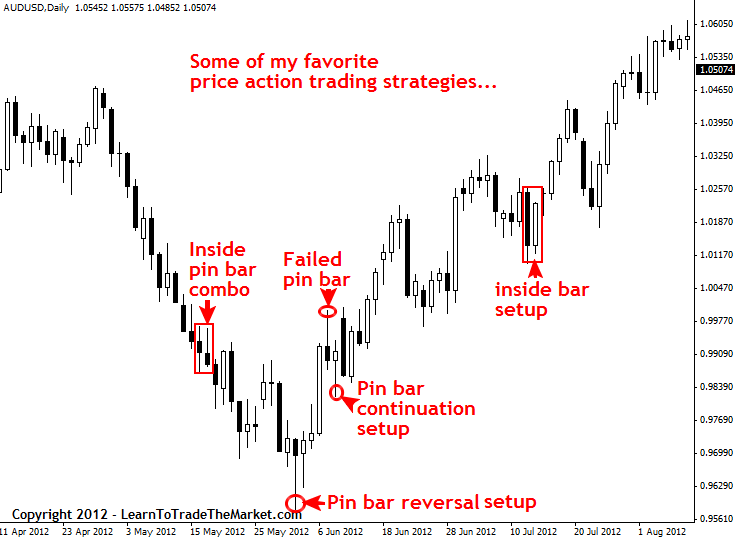

Examples of some of my favorite price action trading strategies:

Next, let’s take a look at some of the price action trading strategies that I teach. Note that I’ve included a “failed” trade setup because not every trade will be a winner; we aren’t here to show you “perfect” past trading results…we are here to teach you in an honest and realistic manner.

In the image example below, we are looking some of my favorite P.A. trading strategies:

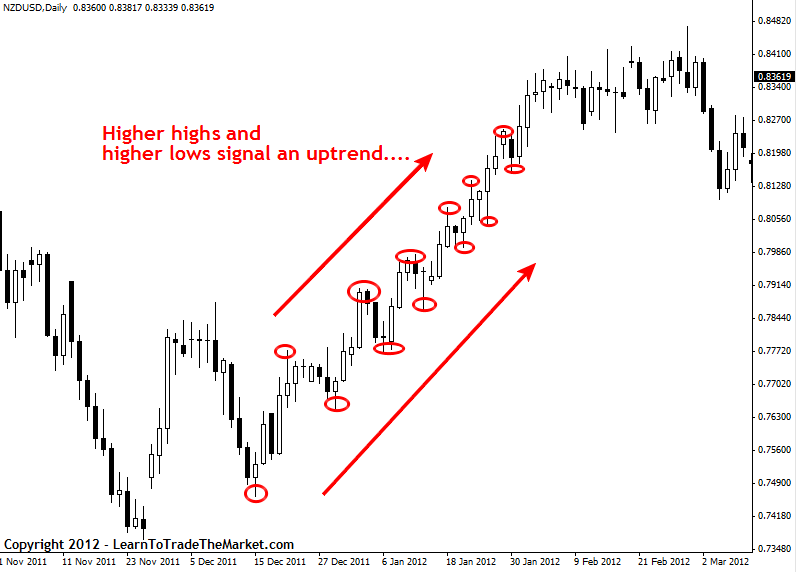

Determine a market’s trend using price action

One of the most important aspects of learning to trade with P.A. is to first learn how to identify a trending market versus a consolidating market. Trading with the trend is highest-probability way to trade and it’s something you HAVE TO learn how to do if you want to stand a chance at making serious money as a trader.

Xem thêm: Hậu Vamc: Nợ Xấu Biến Mất Hay Biến Chất, Cơ Cấu Tổ Chức

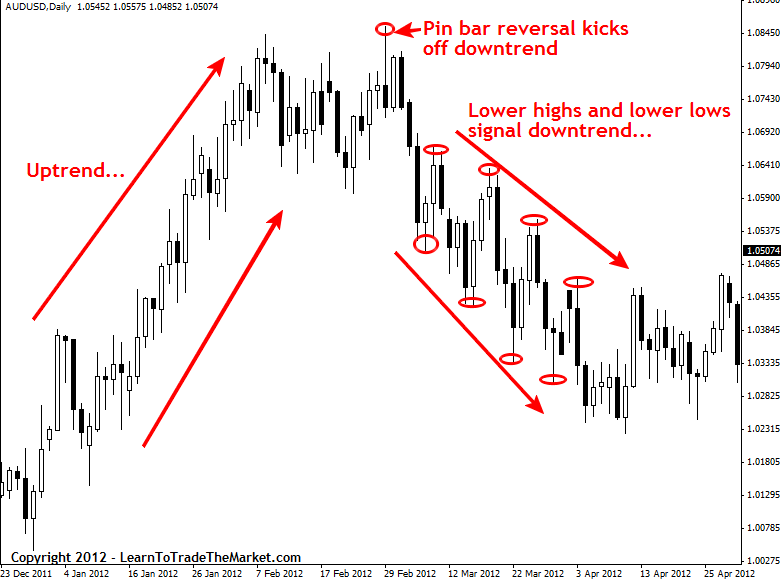

The charts below shows how to use price dynamics to determine a markets trend. We consider a market to be in an uptrend if it is making Higher Highs and Higher Lows (HH, HL) and a downtrend is Lower Highs and Lower Lows (LH, LL).

In the image example below, we can see how higher highs and higher lows signal an up-trend in a market:

In the image example below, we can see how lower highs and lower lows signal a down-trend in a market:

Determine Trending VS. Consolidating markets using price action

As we discussed earlier, P.A.or “price action trading analysis” is the analysis of the price movement of a market over time. From our analysis of price movement we can determine a market’s underlying directional bias or “trend”, or if the market has no trend it is said to be “consolidating”…we can easily determine whether a market is trending or consolidating from simply analyzing its P.A.. We saw how to determine a market’s trend above, to determine if a market is consolidating we just look for an absence of the HH, HL or LH, LL patterns. In the chart below note how the “consolidating price action” is bouncing between a horizontal support and resistance level and is not making HH, HL or LH, LL but is instead going sideways…

The image example below shows a market moving from a consolidation phase to a trending phase:

How to Trade with Price Action Trading Strategies

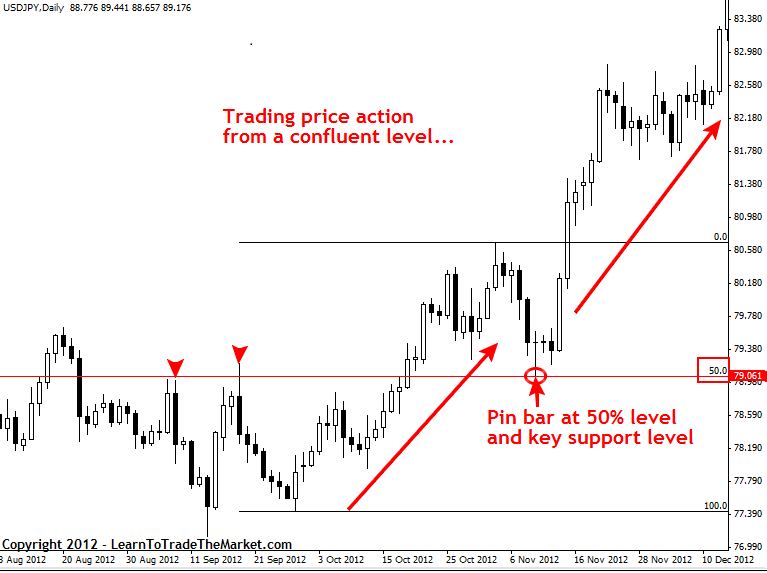

So how exactly do we trade with price action? It really boils down to learning to trade P.A. setups or patterns from confluent levels in the market. Now, if that sounds new or confusing to you right now, sit tight and I will clarify it soon. First we need to cover a couple more things:

Due to the repetitive nature of market participants and the way they react to global economic variables, the P.A. of a market tends to repeat itself in various patterns. These patterns are also called price action trading strategies, and there are many different price action strategies traded many different ways. These reoccurring price patterns or price action setups reflect changes or continuation in market sentiment. In layman’s terms, that just means by learning to spot price action patterns you can get “clues” as to where the price of a market will go next.

The first thing you should to begin P.A. trading is to take off all the “crap” on your charts. Get rid of the indicators, expert advisors; take off EVERYTHING but the raw price bars of the chart. I prefer to use candlestick charts because I feel they convey the price data of the market more dynamically and “forcefully”, if you are still using classic bar charts and want more info on candlesticks then checkout this candlestick trading tutorial.

I like simple black and white charts the best, as you can see below. In metatrader4 you simply right click on the chart and adjust the “properties” of the chart to get it looking like mine below. If you want more info on how to setup your MT4 trading platform checkout this metatrader 4 tutorial.

After you’ve removed all the indicators and other unnecessary variables from your charts, you can begin drawing in the key chart levels and looking for price action setups to trade from.

The image example below shows examples of some of the trading strategies I teach in my price action trading course. Note the key support / resistance levels have been drawn in:

How to trade price action from confluent points in the market:

The next major step in trading P.A. is to draw in the key chart levels and look for confluent levels to trade from. In the chart below we can see that a very obvious and confluent pin bar setup formed in the USDJPY that kicked off a huge uptrend higher. Note that the pin bar trade setup showed rejection of a key horizontal support level as well as the 50% retrace of the last major move, thus the pin bar had “confluence” with the surrounding market structure…

In the image example below, we can see a pin bar setup that formed at a confluent point in the market:

All economic variables create price movement which can be easily seen on a market’s price chart. Whether an economic variable is filtered down through a human trader or a computer trader, the movement that it creates in the market will be easily visible on a price chart. Therefore, instead of trying to analyze a million economic variables each day (this is impossible obviously, although many traders try), you can simply learn to trade price action, because this style of trading allows you to easily analyze and make use of all market variables by simply reading and trading from the P.A. trail they leave behind in a market.

Xem thêm: Cách Nạp Tiền Vào Ví Perfect Money, Hướng Dẫn Nạp Tiền Vào Ví Perfect Money Bằng Vcb

Closing thoughts on Price Action Trading…

I hope today’s introduction to Price Action Trading has been a helpful and enlightening lesson for you. No matter what strategy or system you end up trading with, having a solid understanding of P.A. will only make you a better trader. If you’re like me, and you love simplicity and minimalism, you’ll want to become a “pure” P.A trader and remove all unnecessary variables from your charts. If you’re interested in learning how I trade with simple price action strategies, checkout my Price Action Trading Course for more info.