Exponential Weighted Moving Average S, Weighted Moving Average

Most traders will agree that technical indicators are at the heart of any trading strategy. Traders use them to analyze past price trends and patterns, as well as forecast future market movements in order to make informed trades. While there are many different kinds of indicators available to traders today, the weighted moving average (WMA) remains one of the most popular. That’s thanks to its straightforward formula and its ability to measure market momentum. In this article, we’ll discuss what the weighted moving average is. We’ll also explain how to calculate it and take a look at some detailed examples.

Đang xem: Exponential weighted moving average

Table of Contents Hide

1. What is the Weighted Moving Average?

2. How to Calculate the Weighted Moving Average

3. How The Weighted Moving Average Works

4. Conclusion

M = Average valueV = Actual valueW = Weighting factorn = Number of periods in the weighting group

Source: help.sap.com

A bit confusing? Let’s use it in a few examples to give you a clearer picture of how to use this formula to calculate the weighted moving average.

Example 1

Suppose the closing prices of XYZ stock for the past 3 days have been $50, $45, and $60. Calculate the weighted moving average.

Step 1 – Identify the numbers to average

So here we have the three numbers provided — $50, $45, and $60, which were recorded over a three-day period.

Step 2 – Assign the weights to each number

Since there are 3 periods, the most recent day ($60) gets the largest weight of 3, the second recent day ($45) receives a weight of 2, and the last day ($50) receives a weight of just 1. Of course, this is only a simplistic representation. We’ll cover a more detailed weight assignment in the next example.

Step 3 – Multiply each price by the assigned weighting factor and sum them

Using the WMA formula, the calculation will go as follows: <(3 x $60) + (2 x $45) + (1 x $50)> = 320.

Step 4 – Divide the resulting value by the sum of the periods to the WMA

The sum of the periods is 1+2+3 = 6. So we have (180 + 90 + 50) / 6 = 53.33 as a three-period weighted average. The WMA value of 53.33 compares to the SMA calculation of 51.67. The division by 6 in this step is what brought the weightings sum to 6 / 6 = 1.

Let’s look at another example with a proper look at the weighted factor. Remember, they should add up to 100% or 1.

Xem thêm: Chỉ Số Vn30 Gồm Những Cổ Phiếu Nào ? Vn30 Gồm Những Mã Cổ Phiếu Nào

Example 2

Assume that we want to calculate the weighted moving average of five stock prices over a 7-day period. The prices are $50.25, $56.39, $58.91, $61.52, $59.32, 55.43, and 54.65, with the last price being the most recent. Now we have the numbers that we want to average so the next step is to assign the weighting to each number based on how recent they are and the given period.

| Day | Closing Price | Weighting Factor |

| 1 | $50.25 | 1/28 |

| 2 | $56.39 | 2/28 |

| 3 | $58.91 | 3/28 |

| 4 | $61.52 | 4/28 |

| 5 | $59.32 | 5/28 |

| 6 | $55.43 | 6/28 |

| 7 | $54.65 | 7/28 |

Next, we multiply each of the five closing prices by their corresponding weighting factor to find the weighted average.

| Day | Closing Price | Weighting Factor | Weighted Average |

| 1 | $50.25 | 1/28 | $1.79 |

| 2 | $56.39 | 2/28 | $4.03 |

| 3 | $58.91 | 3/28 | $6.31 |

| 4 | $61.52 | 4/28 | $8.79 |

| 5 | $59.32 | 5/28 | $10.59 |

| 6 | $55.43 | 6/28 | $11.88 |

| 7 | $54.65 | 7/28 | $13.66 |

| SUM | – | 1 | $57.05 |

Then you add up all of the weighted average individual values to arrive at the WMA. The WMA for the five stock prices over the 7-day period is $57.05.

How The Weighted Moving Average Works

Now that you know how to calculate the weighted moving average of a given set of values, let’s look at how you can use this indicator for your trades:

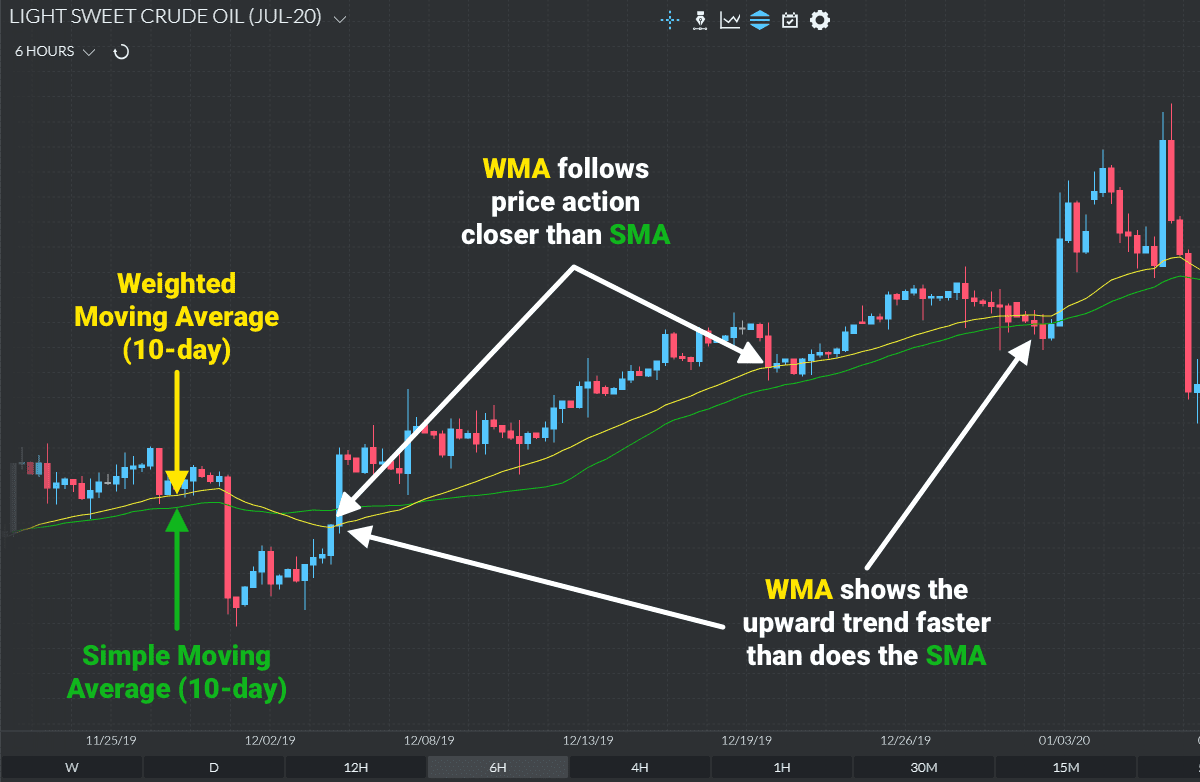

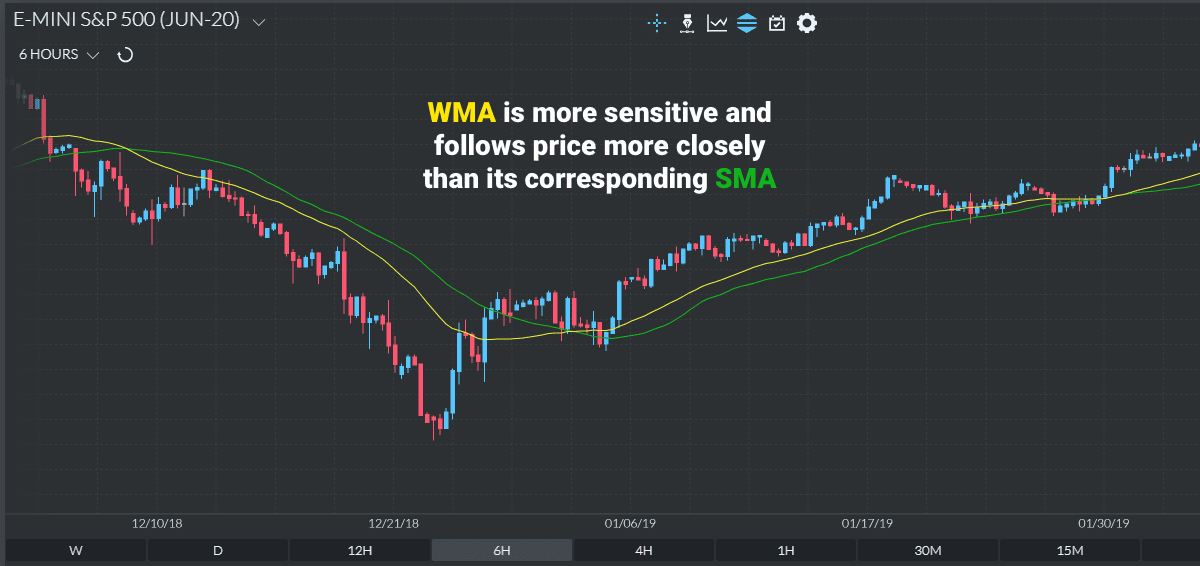

To help determine trend direction – When the price is above its weighted MA line, it’s usually a signal that on average, the asset is trading higher than it has over the period being analyzed. This in turn confirms an uptrend. Alternatively, when the price is below the WMA line, then it confirms a downtrend.To indicate support and resistance areas – A rising weighted MA can indicate support for price action. While a falling WMA can indicate resistance to price action over a given period. Traders tend to use this as a strategy to place buy orders when the price is near the rising WMA or place sell orders when the price is near the falling weighted MA.To validate price strength and market momentum – Price action above its moving average shows that the market is getting stronger relative to where it was in the past since the most recent prices now sit higher than the average. On the flip side, price action below its moving average shows that the market is getting weaker relative to where it was in the past.To measure price movement – The weighted moving average is generally more sensitive to price movement making it a better measure as well as identifying trends sooner than the SMA. However, this can be a double-edged sword as the WMA is likely to experience more volatility than its corresponding SMA.

Xem thêm: Đồng Tiền Ảo Firstcoin Là Gì ? Firstcoin Là Gì Và Một Số Đặc Điểm Nổi Bật

Conclusion

Knowing how to use the weighted moving average in conjunction with other technical indicators is an important skill to have as a trader. That being said, one type of moving average isn’t necessarily better than others as they simply have different calculation methods for average prices. As such, your trading strategy will ultimately determine what type of MA works best. Additionally, consider adjusting your settings slightly for each market; you may find that a 50-period WMA may provide great signals on one stock, but may not work so well on another. Like any other tool, the key is to know how to use and interpret the WMA to give you the best possible outcomes on your trades.